What is OCEN (Open Credit Enablement Network)?

Table of Contents

Introduction

In today’s dynamic and fast-paced world, the synergy between technology and business has become an undeniable force, driving companies towards unprecedented growth and success. India’s finance sector has also undergone a monumental transformation, and at the heart of this revolution lies the integration of technology. From UPI driving the digital payments to the banks dominating mobile banking, technology has become the driving force reshaping the landscape of Indian finance sector.

One notable addition to this transformation is the Open Credit Enablement Network, also commonly known as OCEN, which is gaining significant attention lately for all the right reasons. OCEN sets a new standard in the formal financial sector, aiming to democratize and standardize access to credit lines, particularly for micro, small, and medium-sized enterprises (MSMEs) as well as individuals.

What is OCEN?

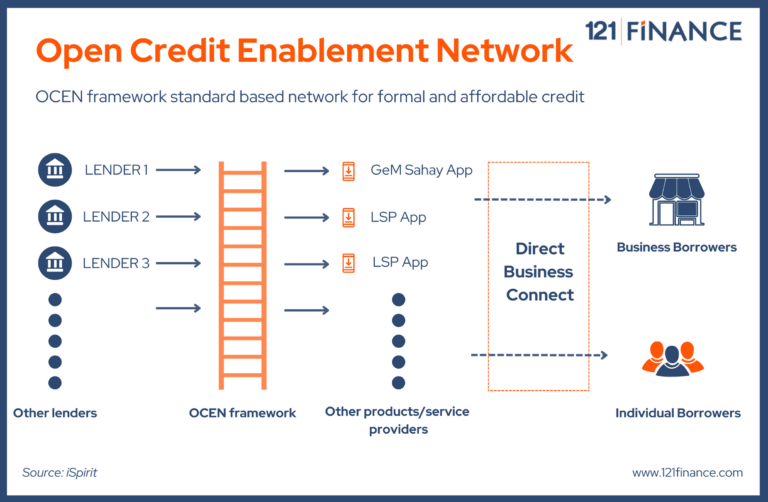

OCEN is a framework of APIs which aims to facilitate seamless, quick and primarily collateral free loans to the most deserving category of the country which are micro, small and medium enterprises (MSMEs). By enabling seamless communication between borrowers, lenders, loan service providers and account aggregators, OCEN is using technology to benefit all the parties involved, making it easy to get and disburse loans with less risk and more involvement.

Every business understands the importance of working capital while running a business. MSMEs tremendously suffer because of late payments or the 30-60 days traditional waiting period to get paid. However, through these APIs, borrowers can easily obtain small credit loans on the same day to tackle the late payment from customers and have streamlined cash flow.

Additionally, OCEN’s APIs foster the creation of innovative financial credit products that bring advantages to both borrowers and credit providers. This further enhances the efficiency and inclusivity of the credit system in the country.

How OCEN Works?

A small business in South Andaman is a vendor of computer parts and gadgets on the Government e-Marketplace (GeM). To fulfill orders, the business owner relies on a limited credit line from a bank. Businesses relying on credit line often face several challenges like limited funding, high collateral requirements, lengthy approval process etc. Here comes OCEN’s first ever product, GeM Sahay, an app-based lending platform that connects GeM vendors with various lenders who offer working capital and unsecured loans against their government purchase orders (POs).

The platform digitally maps POs and invoices, simplifying credit assessment. OCEN framework eliminates the need for collateral and offers seamless Aadhaar-based sign-ups, making the whole journey, from signing up to getting loans completely digital. GeM Sahay allows the business owner to choose from multiple lenders offering loans at different interest rates.

This platform is part of the Open Credit Enablement Network (OCEN). Since it is an open network of APIs that enables interaction between borrowers, lenders, and intermediaries which result in lead generation, credit assessment, loan disbursal, and repayment.

The upcoming LSP from OCEN is GST Sahay, which will assess borrowers’ creditworthiness based on their tax payments, is in development. The combination of OCEN, and the United Payments Interface (UPI) is expected to be the foundation of India’s digital transformation, especially for onboarding small businesses onto the digital platform.

OCEN 4.0

OCEN 4.0 is the latest version of the Open Credit Enablement Network (OCEN) protocol and is built on the previous versions of OCEN. New features of OCEN 4.0 are:

- A registry of lenders, loan agents, and other participants in the OCEN ecosystem

- A product network that allows lenders to offer a wider range of credit products to borrowers

- Rules and regulations that govern the conduct of lending activities

- Specialized participant roles that allow different types of entities to participate in the OCEN ecosystem

- With a local network of participants, the burden on lender is reduced resulting in increased credit accessibility in underprivileged areas.

These new features make OCEN 4.0 a more powerful and flexible platform for cash flow-based lending. Let us have a look at how OCEN 4.0 is improving the ecosystem:

› Increased access to credit: OCEN 4.0 makes it easier for MSMEs to obtain credit by reducing the cost and complexity of the lending process

› Improved terms and conditions: OCEN 4.0 will help MSMEs to get better terms and conditions on their loans, such as lower interest rates and longer repayment terms

› Increased transparency: OCEN 4.0 provides greater transparency in the lending process, which helps MSMEs to make informed decisions about their borrowing

› Reduced risk: OCEN 4.0 will help MSMEs to reduce their risk by providing access to more data about their businesses

ONDC: Empowering Digital Commerce

OCEN is a crucial part of a broader vision for transforming India’s digital economy with other initiatives like Open Network for Digital Commerce (ONDC). ONDC, which is storming social media these days for bringing the top vendors on its platforms is much like OCEN. It is a framework of APIs designed to bring openness, innovation, and inclusivity to India’s digital commerce landscape. ONDC enables various participants, including retailers, startups, and technology platforms, to build innovative e-commerce solutions and leverage a common set of APIs for cataloging, ordering, and fulfilment. These set of APIs can be used to create an ecosystem which brings all the businesses with similar framework together.

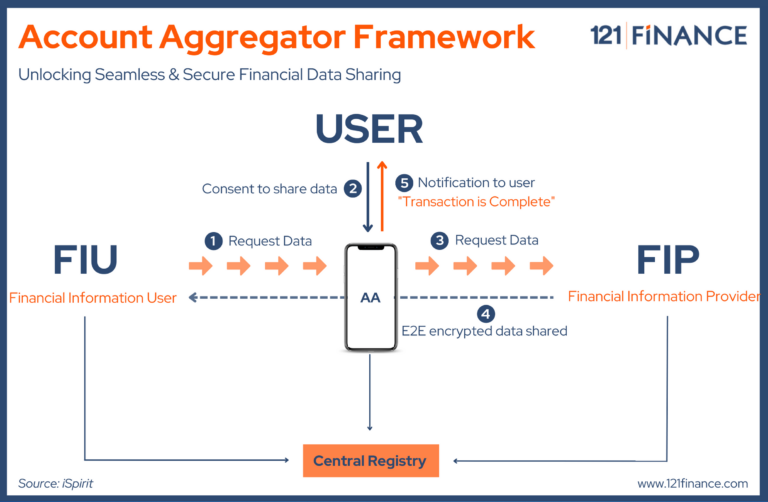

Account Aggregators: Unlocking Financial Data Sharing

Account Aggregators are entities that facilitate the seamless and secure sharing of financial information between financial institutions, individuals, and businesses. The main idea behind AA is for a company to access tamper-proof secure data (with consent) quickly to fast-track the loan evaluation process for businesses and individuals. These aggregators provide a consent-based mechanism through which users can grant access to their financial data to authorized parties, such as lenders, insurers, or financial advisors. This data-sharing mechanism is set to revolutionize the credit assessment process, making it more efficient, accurate, and secure.

How OCEN, ONDC, and Account Aggregators Work Together?

With ONDC’s APIs, businesses can create a digital storefront, showcase their products, and manage orders. Meanwhile, the business’s financial data, transactions, and credit history are securely accessible through an Account Aggregator. Lenders, powered by OCEN, can access this data with the borrower’s consent, resulting in quicker, more accurate credit decisions.

Benefits of OCEN for Lending System in India

› Access to Affordable Credit: One of the significant challenges faced by MSMEs is obtaining affordable credit from traditional financial institutions like banks. OCEN aims to create a decentralized credit ecosystem where various lenders can participate and offer credit to MSMEs at competitive interest rates, thereby increasing their access to much-needed funds for business growth and expansion.

› Increased Financial Inclusion: Many MSMEs lack formal credit histories, making it difficult for them to qualify for loans from traditional banks. With OCEN, alternative data sources can be utilized, such as digital transaction records, to assess creditworthiness.

› Transparency and Security: OCEN operates on distributed ledger technology (blockchain), which ensures transparency and security in transactions. Every participant in the network can view the data and verify the authenticity of transactions, minimizing the risk of fraud and enhancing trust among lenders and borrowers.

› Reduction of Intermediaries: In traditional credit ecosystems, there are several intermediaries involved, leading to higher transaction costs for borrowers and lenders. OCEN aims to eliminate or reduce the number of intermediaries, which can result in cost savings and more efficient credit allocation.

› Flexibility in Loan Products: With multiple lenders participating in the OCEN network, MSMEs can access a diverse range of loan products tailored to their specific needs.

› Quick and Seamless Loan Approval: Traditional loan approval processes can be time-consuming and tedious. OCEN’s digital platform enables streamlined loan application, verification, and approval processes, leading to quicker access to funds for MSMEs.

› Data Privacy and Control: While using alternative data sources for credit assessment, OCEN emphasizes data privacy and empowers MSMEs to have control over their data. It allows businesses to choose what information to share with lenders, enhancing data security and minimizing the risk of data misuse.

› Improved Credit Rating and Reputation: Timely repayment of loans through the OCEN network can contribute to building a positive credit history for MSMEs. This can enhance their credit rating and reputation, making it easier for them to access credit in the future.

Conclusion

The once daunting challenges of obtaining affordable credit, navigating complex loan approval processes, and addressing the financing gap for MSMEs are being met with streamlined solutions. The emergence of the Open Credit Enablement Network (OCEN) stands as a beacon of change in India’s financial landscape. This transformative framework, fueled by the synergy of technology and innovation, has revolutionized access to credit for micro, small, and medium-sized enterprises (MSMEs) and individuals across the country. As a result, the financial inclusion of underserved businesses is becoming a reality, bolstered by the use of alternative data sources, innovative credit products, and data-driven risk assessment models.

Share this article: