Truth About Working Capital Myths

“Cash is like blood in the veins. It is the lifeline of any business.”

— Ratan Tata

Cash flow, the pulse of every business, dictates the rhythm of operations and the course of growth. The more a business owner understands their cash flow, the more empowered they become. Improved financial stability, flexibility, better decision-making, and numerous opportunities for growth are just some of the advantages of a positive cash flow. Businesses often encounter challenges in maintaining optimal cash flow. There is really only one way to address cash flow crunches, and it’s planning so you can prevent them in advance. Effective working capital management serves as the first step toward preparation. By managing cash flow today, you gain a clearer understanding of your future needs.

Working capital management can become uncertain when there is a misunderstanding of its principles. With numerous myths surrounding working capital solutions and management, the trajectory of your company’s performance and viability can quickly decelerate. By employing the right working capital management methods, a business can amplify its cash flow, navigate challenges effectively, and thrive in ever-evolving and seasonal markets. Here are five common working capital myths and the corresponding facts that you must know.

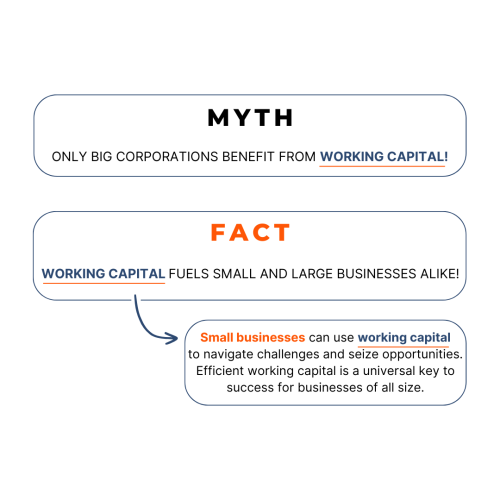

Myth 1

Only Large Corporations Benefit from Working Capital

Working capital isn’t exclusive to large businesses. It serves as a catalyst for growth and stability for businesses of all sizes. Small businesses can leverage working capital financing for:

- smooth operations

- seizing new opportunities

- managing seasonal fluctuations

- building creditworthiness and fostering overall growth

Myth 2

Working Capital is Just for Covering Daily Expenses

While working capital helps cover daily expenses, its uses extend far beyond that. It empowers businesses to innovate, invest and expand horizons to drive long-term success

- invest in growth initiatives

- manage cash flow fluctuations

- capitalize on strategic opportunities

Myth 3

Working Capital is Isolated to Short-Term Goals Only

Working capital isn’t just about short-term gains, it plays a crucial role in long-term stability and prosperity of business. Strategic management of working capital sets the stage for sustainable growth and ensures business resilience over time.

Strategic working capital management can:

- support invest in growth initiatives

- enhancing financial flexibility

- promote vendor and supplier relationship

Myth 4

More Inventory Means Better Working Capital

There’s a misconception that increasing inventory levels improves working capital. Optimal inventory management is crucial for working capital health. Balancing inventory levels to meet demand without excess is key to efficient capital utilization and enhanced overall financial performance.

Balancing your inventory will:

- reduce holding costs

- minimize risk of obsolescence

- improve cash conversion cycle

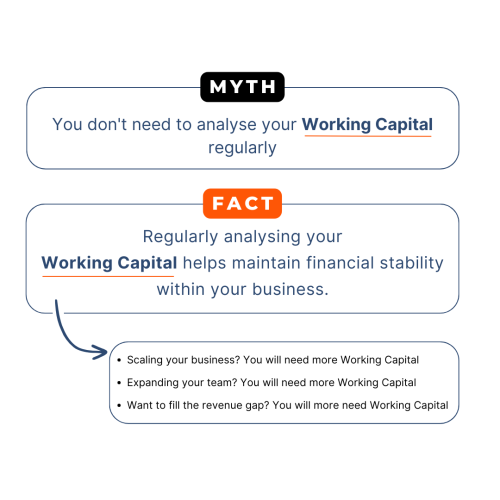

Myth 5

You Don't Need to Analyze Your Working Capital Often

Consistently analyzing your working capital helps maintain financial stability, enhances operational efficiency, and optimizes cash flow management. It’s like regularly checking the vital signs of your business to ensure it remains healthy and thriving.

Constantly analyzing your working capital means:

- identifying areas of improvement

- anticipate and prepare for potential financial challenges

- easy resource allocation and drive sustainable growth

In the words of Benjamin Franklin, ‘Beware of little expenses. A small leak will sink a great ship’. This timeless quote perfectly encapsulates the essence of working capital management. As a business you must constantly monitor and manage working capital to navigate the turbulent waters of the market. It will keep your business protected and help in sustaining long-term success.

Share this article: