Purchase Finance

Flexible & Easy Financing for your Business Purchase Needs. Empower Your Business with Our Quick & Flexible Working Capital Solutions

RBI Registered NBFC-FACTOR

MSME / SME Oriented

Tech Driven

Customised Programs

Get Started

What is

Purchase Finance

from 121 Finance?

At 121 Finance, we understand the challenges that MSMEs face when managing working capital. Our Purchase Finance Solutions are designed to provide businesses, with a Buyer Credit, for all their purchase needs or secure large orders.

Top Features of Purchase Finance

Small Ticket Size

Empowering small businesses with funding for smaller purchase amounts

Credit Limit

up to twice* your PO value

Digital Process

Experience a fully digital, simplified process to quickly access funds

RBI Registered NBFC-Factor

Ensuring transparency, compliance, and trust in every transaction

Quick Approvals

Get the financing you need without any delay & seize new opportunities

Self-Disbursement

DIY process, allowing you to control disbursements like Bank CC without manual intervention

Value Added Benefits

Leverage Early Payment Discounts offered by sellers

Access to

Non-Credit Suppliers

Finance Both

Purchase Orders and Invoices

Benefits of Purchase Order Financing to Buyers

Instant Payment to Sellers

Collateral Free Finance

Better Supplier Relationship

Improved Working Capital

Revolving Credit

Grow Revenue & Profitability

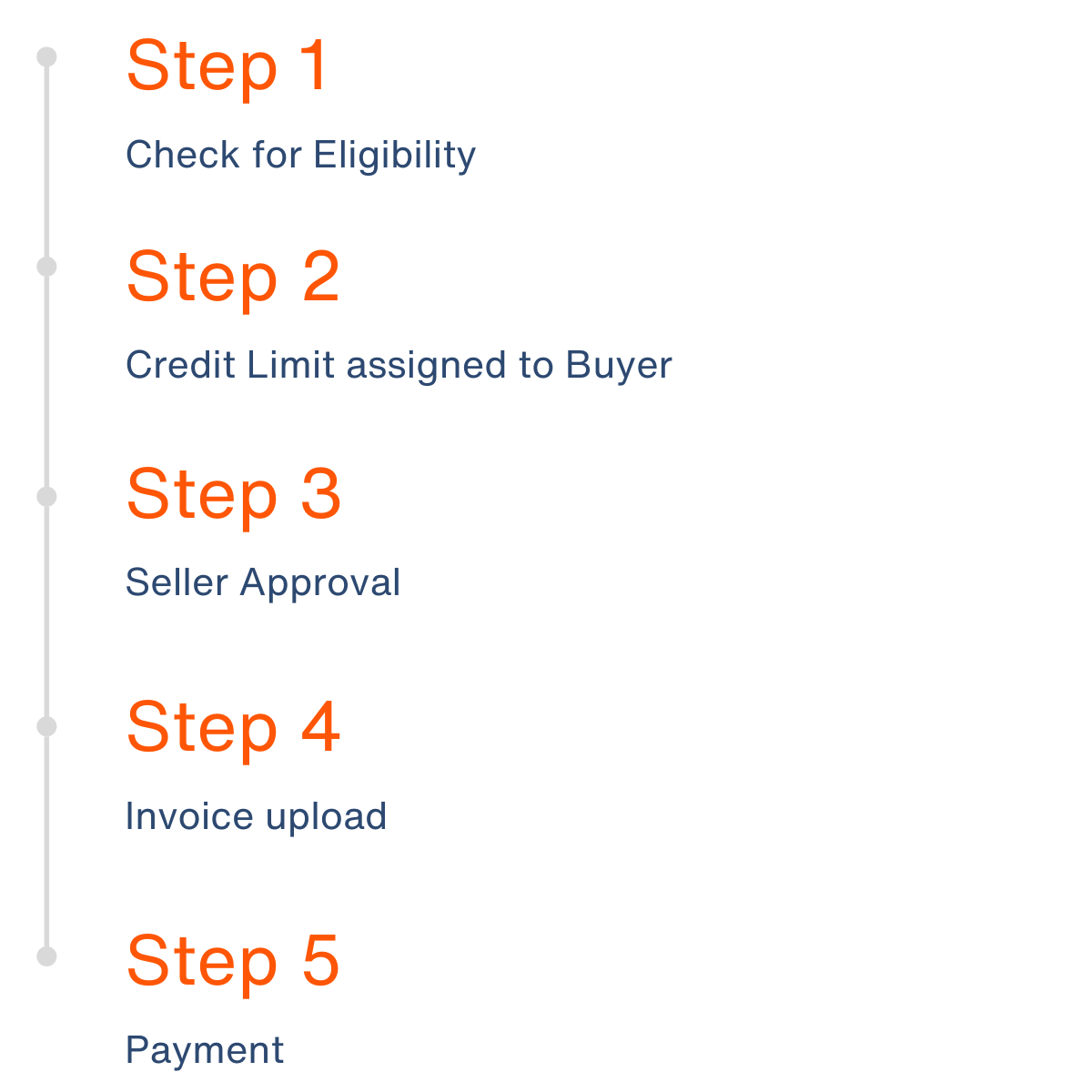

How it Works?

Step-by-Step Process to get Financed Quickly!

How it Works?

Step by Step Process to apply for Financing – Complete digital process

Step 1

Check for Eligibility

Step 2

Credit Limit assigned

Step 3

Seller Approval

Step 4

Invoice upload

Step 5

Payment

What we need?

GSTR details

for the current fiscal year

Financial Statements

for the last 2 fiscal years

Bank Statements

for the immediate past one year

KYC Documents

for business & its owners

Additional Documentation

as required for approval*

FAQ

What is Purchase Finance and who can benefit from it?

Purchase Finance, also known as Payable Finance or Accounts Payable Finance helps small businesses & MSMEs to fulfill large orders by providing the necessary funds to pay suppliers for raw materials, inventory, or other required goods. It allows them to grow without being constrained by working capital shortages.

What is the difference between Purchase Finance and business loans?

Purchase Finance is specifically tied to funding the purchase of goods required to fulfill an order, making it short-term and transaction specific. It directly helps businesses cover supplier payments. Getting Purchase Finance is faster and more flexible than a traditional business loan. A business loan is a broader financial product, not necessarily tied to a specific transaction or order, and is usually long-term with fixed monthly EMI repayment terms.

What is the eligibility for Purchase Finance?

Eligibility for Purchase Finance depends on your business’s financial health and operational history. Typically, businesses with a minimum annual turnover of over ₹5 crore and a business vantage of at least 3 years are eligible. However, the final assigned limit considers other factors as well.

What is the maximum limit I can get for purchase finance?

The maximum limit depends on various factors, including your specific financing requirement, your business’s eligibility, and our credit assessment process. If your business meets our basic guidelines and our team is comfortable with the credit evaluation, we offer a competitive working capital limit suited to your needs.