Difference between

Factoring Finance and Invoice Discounting:

Choosing the Right Financing Solution for your Business

“Financing isn’t a one-size-fits-all solution. Customizing it to your business needs unlocks untapped potential.”

Trade credit challenges are not new for small business in India. Despite contributing nearly 30% to the nation’s GDP, the MSME sector continues to grapple with a massive credit gap of ₹20–25 lakh crores, leaving nearly 47% of their credit needs unmet.

While banks and NBFCs have introduced various financial solutions to address this issue, the lack of awareness and limited penetration of these services remain significant barriers.

Even for businesses that are aware of these options, another challenge arises: selecting the right solution for their specific needs. Two financial tools that often leave business owners confused are Invoice Discounting and Factoring Finance. Because both of them use invoices/receivables to fund the business.

Let’s dive deeper into how these two invoice financing options can impact your business.

What is Factoring Finance?

Factoring Finance is becoming popular as the preferred trade receivables finance as it helps businesses to improve their cash flow and also cover their credit risk.

In Factoring, the seller sells its receivables to a financial institution (commonly known as a Factor) at a discount. After the sale, there is an immediate transfer of ownership of the receivables to the Factor. Over time, payments are collected by either the factor or the other business, depending on the type of Factoring.

Factoring is not a loan but a financial agreement, making it an off-balance sheet solution.

Factoring offers several Features that makes it an attractive solution for businesses:

- Immediate Funding

- Risk Mitigation with Trade Credit Insurance

- Receivables Management

- Collection & Settlement

The Factoring advantages are beneficial for MSMEs/businesses operating in industries with long payment cycles, where consistent cash flow is essential to maintain operations.

Note: More and more NBFCs are registering as the NBFC-Factor from the Reserve Bank of India after the 2022 Factoring regulations.

What is Invoice Discounting?

Invoice Discounting is a financing method that allows businesses to borrow funds against the value of their unpaid invoices. In invoice discounting, the business retains control of its sales ledger and manages customer collections independently.

Invoice Discounting is a loan and will appear as a liability on your balance sheet.

Unique Features of Invoice Discounting that businesses can benefit from:

- Confidentiality

- Flexible Financing

- Lower Cost

Note: Platforms like TReDS use Invoice Discounting to offer funding against the unpaid invoices.

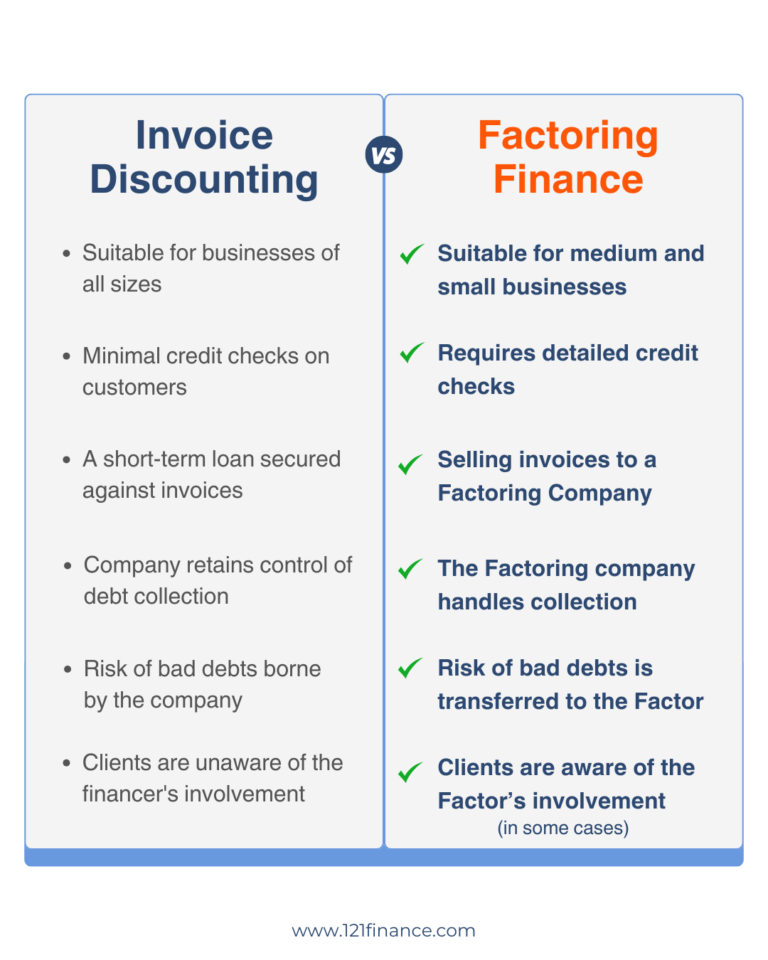

Key Differences Between Factoring Finance vs Invoice Discounting

Conclusion

Both Factoring Finance and Invoice Discounting are viable trade credit finance solutions, each designed to cater to specific business needs. Understanding the unique features of both solutions is essential for selecting the one that aligns with your business and its objectives. While Invoice Discounting provides flexibility and confidentiality, Factoring offers value added benefits such as receivables management, credit control, and trade credit risk mitigation through Trade Credit Insurance, making it a robust solution offering comprehensive financial support.

Share this article: