How digitalization has added a layer of Independence and support to the MSME sector?

Table of Contents

Introduction

The biggest part of the ongoing digital transformation is that it changes the way we think. A few years back no one thought to look up a new word on the internet. Now, instead of pulling out a dictionary we pull out smartphones from our pockets and look for the meaning of that word instantly. That’s what is fascinating about digital transformation when it is done right. It’s like a caterpillar turning into a butterfly and that’s what every size of business, especially MSMEs, need to seek.

The last few years have been amazing for India in terms of going online. The internet and digital innovations have already made a mark by contributing up to $537.4 billion to India’s GDP in 2020. With their further expansion, this number is poised to grow at an exponential rate. Thanks to this digital transformation, it’s safe to say MSMEs and other small businesses have got an extra layer of independence and support to run their business efficiently. And to withstand these rapid changing times and bring in growth and revenue, it is important to step up the game for which digitalization is the key.

For instance, getting easy access to working capital and supply chain finance was and still is a bigger problem for businesses. Small ticket size enterprises, starting from scratch, have no collateral and suffer from it. The government schemes and new-age NBFCs have been trying to make this process simpler for many years now but because of delay in sharing information within the organizations and constrained time limits, the problem still persists for the masses. However, digital and physical worlds are starting to come together more seamlessly, and making things easier for MSMEs in terms of working efficiently, finding more customers and primarily getting easy access to working capital credit without hampering their growth.

How has Technology Improved Services Offered by NBFC?

Large enterprises have landed big opportunities by upgrading and digitizing their internal processes. Following suit, New-age NBFCs are leveraging the power of the internet wisely by incorporating the latest technologies to make things simpler for businesses of all sizes. Over the years NBFCs have played a pivotal role in meeting financial needs of businesses that have traditionally remained un-served or underserved by banks.

With the help of operational models powered by technology, NBFCs are now more focused on welcoming innovative solutions like Factoring Finance that cater to unorganized sectors. They can now figure out the business’s requirements rapidly, offer customized finance solutions that aren’t traditionally available, and provide manageable lending solutions that can tremendously help small businesses with growth and expansion.

How Does Digitalization Help the NBFCs to Deliver Services Smoothly?

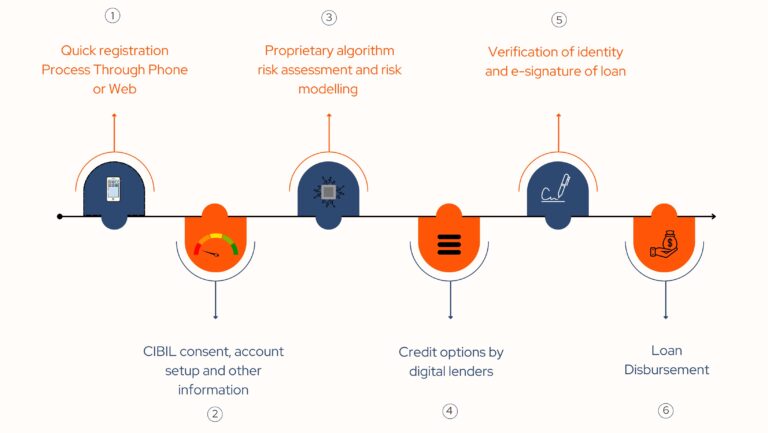

New-age NBFCs are using technology more than ever to create a positive ecosystem, especially for small businesses where they can get access to funds within 24-48 hours as opposed to long waiting periods; and keep their processes running, without any halt. Smartphone penetration has enabled NBFCs to fasten the process of lending as methods like e-KYC, and e-signature can be easily done within a few minutes and result in rapid disbursements. Inclusion of technologies like Artificial Intelligence (AI), machine learning (ML) and big data are helping NBFCs to measure individual customer insights and even build alternative credit models. The technology and digitalized driven business model unified by NBFCs aim to reduce dependency on manual tasks which is making the underwriting process swift, organized and transparent for businesses as well.

For instance, Factoring Finance doesn’t care about the business’s credit score, current loans, past dues or any type of missed payments with the other lenders because in Factoring, businesses sell their invoices to the Factor and get instant payments without waiting for their customers to pay.

Challenges new-age NBFCs face in today’s date

Banks are often reluctant to extend loans to small businesses for many reasons. MSME owners tend to believe that the unavailability of adequate collateral free credit still persists in the market and practices the old-school borrowing from friends & family. NBFCs offering new and easy solutions that dedicatedly tackle the working capital and supply chain needs often face the major issues:

- Not gaining the trust of small ticket size businesses for their lending needs

- Almost negligible flow of credit at the bottom of the pyramid

However, the recent pandemic and the subsequent lockdown have fairly changed people’s preferences when it comes to lending. The collateral free solutions offered by new-age NBFCs will play a substantial part in strengthening the Indian lending sector and help MSMEs with growth in upcoming years. In the semi-urban areas, more businesses are already moving their accounts to NBFCs in order to get paid instantly for their services/products rather than waiting for their customers to pay.

Moreover, NBFCs are leveraging digital advancements like websites, social media, and other means to spread the information in the market. It will allow more businesses to learn that alternative credit options are also available in the market as MSMEs do not have to largely depend on banks for their credit needs. With RBI supporting new ideas like Factoring through Factoring Regulation Act, 2011 and Payment & Settlement Systems Act, 2007 to support and ease processes, the future seems bright for MSMEs and for NBFCs in this era of digitalization.

Digitalization – Key to Easy Access to Loans

Getting a business loan was never easy in India. Along with the long and slow working process, missed opportunities due to lack of funds were becoming standard while running a business. However, a digital paradigm shift has benefited businesses, especially MSMEs seeking credit without collateral. Now, one can apply for a loan and avail disbursement in under 24 hours, as Digitalization and usage of advanced tools by NBFCs make it possible.

Instead of filling out reams of paperwork and submitting it to the nearest lenders, businesses now can get money in their accounts with a few clicks. It not only reduces the spending of valuable time but also offers the convenience of getting credit anytime and anywhere. Under the idea of Aatmanirbhar Bharat or self-reliant India, it’s great to see new-age NBFCs extending support to MSMEs (backbone of our country) by helping them tackle their financial needs without any

hassle. Easy documentation, simple and flexible EMIs, several credit options, competitive interest rates and primarily collateral free credit are just some advantages of Digitalization in the lending sector. NBFCs are leveraging this change for them and the customers’ benefit as India moves ahead with pride and dignity.