Factoring Finance in Garment Industry

Addressing Long Payment Cycles & Section 43B(h) Compliance

“The right financial solution and the right partner can help you turn

Challenges into Opportunities”

The garment industry is no stranger to long payment cycles, often ranging between 90 to 120 days. For suppliers, this means enduring prolonged periods without receiving payment for products already delivered, suppliers’ cash flow and working capital.

Adding to these challenges is the recent amendment to Section 43B(h) which mandates payments to Micro and Small Enterprises within 45 days. This regulatory change has intensified strain on buyers who are accustomed to longer credit terms.

In this complex landscape, Factoring Finance emerges as a bridge that addresses long payment cycles for suppliers and helps buyers comply with regulatory requirements. It establishes trust and strengthens the relationship between buyers and Suppliers in the garment industry.

Let’s understand how factoring finance effectively tackles these challenges. But before, let’s address an important question.

Why are Long-Payment Cycles Common in the Garment Industry?

Long Manufacturing & Production Cycles: For buyers, the manufacturing can take up to a significant amount of time. The operations like sourcing material, production, quality checks and logistics can take up to 90 days or more. Buyers often delay payment to suppliers until they have inspected the final goods or sold a portion of the inventory.

Seasonal Demands & Cash Flow Management: The garment industry is heavily influenced by seasonal demand. Many times, buyers time their payments in alignment with sales cycles which delays paying the suppliers.

Credit as a Market Practice: As mentioned earlier, extended credit terms have become a standard practice in the industry, with buyers relying on credit to manage their cash flow. This creates a cycle of long payment terms across the supply chain.

How Factoring Finance Solves Long Payment Cycles

in the Garment Industry?

Factoring Finance targets the delay between invoice generation and payment to Suppliers, particularly MSMEs, who largely depend on timely payments to sustain operations. Additionally, large buyers often have greater negotiating power over small suppliers, enabling them to dictate longer payment terms. Suppliers, especially MSMEs, in turn, had to accept these terms to secure contracts, even at the cost of delayed payments. This adds extra weight on small businesses, as the funding for MSMEs is already a challenge in the country.

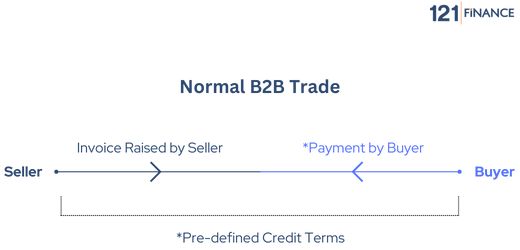

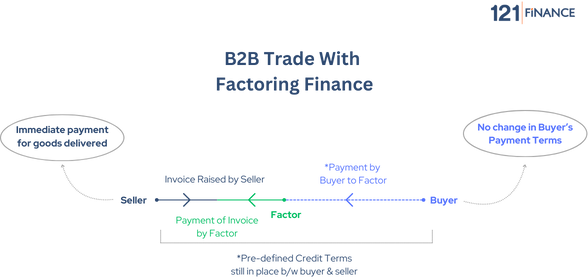

Factoring Finance is a solution in which the seller sells its receivables to a financial institution (commonly known as a Factor) at a discount. Instead of waiting for buyers to clear payments, Suppliers can get up to 90% of their invoice value using Factoring, ensuring consistent cash flow.

Beyond just faster payments or immediate funding, factoring offers additional benefits, including:

- Risk Mitigation with Trade Credit Insurance

- Receivables Management

- Collection & Settlement

How Factoring Finance Helps Buyers Comply with Section 43B(h)?

The recent amendment to Section 43B(h) of the Income Tax Act mandates has created challenges for buyers in the garment industry, particularly those accustomed to long credit terms. This regulation not only impacts cash flow management but also disrupts long-established operational practices.

Factoring finance offers a seamless solution to these challenges. It ensures that Micro & Small Suppliers are paid within the mandated 45-day period without straining the buyer’s cash flow.

“For instance, a buyer who traditionally operates on a 90-day payment cycle can now comply with the 45-day rule by leveraging a factor, ensuring timely supplier payments without disrupting their cash flow planning.”

Benefits of Factoring for Buyers:

- Timely Payments to Suppliers

- Compliance with Tax Regulations

- Preserve Buyer-Supplier Relationship

Conclusion

Factoring Finance is a catalyst for operational efficiency, regulatory compliance, and sustainable growth in the garment industry. By adopting Factoring Finance, a trade receivables finance solution, both buyers and suppliers can thrive in a dynamic and competitive market landscape.

Share this article:

Unlock the true potential of your account receivables

Disclaimer: The information provided in this blog is for general informational purposes only. The specifics of financial products, including eligibility, terms, and benefits, may vary based on multiple factors.

121 Finance does not guarantee the accuracy or applicability of the information for every individual case.