Factoring Finance

RBI Registered NBFC-FACTOR

MSME / SME Oriented

Tech Driven

Customised Programs

Get Started

What is

Factoring Finance?

Factoring allows businesses to sell their receivables (unpaid invoices) for immediate cash, to manage cash flow easily. We are India’s first RBI-registered NBFC-Factor (post RBI 2022 Factoring regulations). Our Factoring Finance, designed for businesses of all sizes, covers their Liquidity and Risk by accelerating payment on their B2B invoices.

Top Features

SME & MSME Oriented

Tailored to meet the needs of small and medium-sized businesses

Customised Programs

Flexible solutions designed to fit your unique business needs

Complete Digital Process

Experience a fully digital, simplified process to quickly access funds

RBI Registered NBFC-Factor

Ensuring transparency, compliance, and trust in every transaction

Quick Approvals

Get the financing you need without any delay & seize new opportunities

Collection & Receivable Management

Handling collections, allowing you to focus on business

Value Added Benefits

No Impact on CIBIL

Off-Balance Sheet Product

Debtor Credit Risk Covered

Benefits of Factoring Finance to Small Business

No Additional Interest Charges

Collateral Free Finance

Better Supplier Relationship

Improved Cash

Flow

Risk-Free Solution

No Fixed EMI obligation

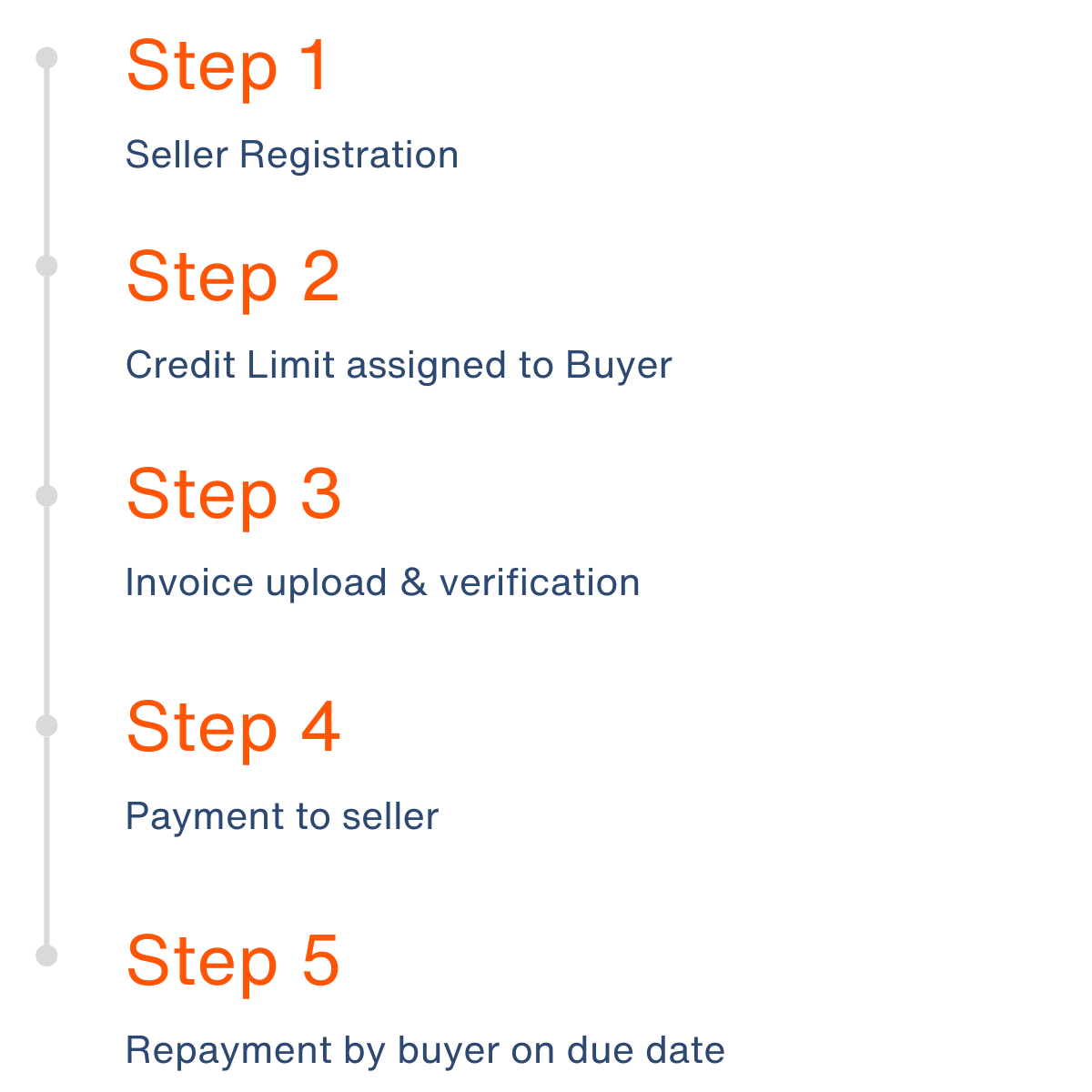

How it Works?

Step-by-Step Process to get Financed Quickly!

What we need?

GSTR details

for the past 12 months

Financial Statements

for the last 2 financial years

Bank Statements

for the immediate past one year

KYC Documents

for business & its owners

Additional Documentation

as required for approval*

FAQ

What is Factoring and who can benefit from it?

Factoring Finance allows businesses to unlock cash tied up in unpaid invoices. It is beneficial for MSMEs and small businesses that need working capital to manage daily operations, fulfill new orders, or invest in growth without waiting for invoice payments.

How is Factoring different from a loan?

Unlike loans, Factoring does not require collateral. Factoring is selling your receivables, so it doesn’t affect your credit score. Repayment is done when the buyer makes the payment, unlike loans with a fixed due date.*

Is Factoring available for all sizes of businesses?

Yes, Factoring Finance is available for all sizes of businesses. Our Factoring solution also supports small ticket size trade which is beneficial for MSME and SME businesses.

How does Factoring impact my relationships with clients?

Factoring improves your customer relationships. For instance, by ensuring timely payments to your suppliers, you can negotiate better terms and offer more competitive deals to your customers, enhancing business trust and reliability.