Trade Credit Finance

Seamless Credit for Growing Your Business. Empower Your Business with Our Quick & Flexible Working Capital Solutions.

RBI Registered NBFC-FACTOR

MSME / SME Oriented

Tech Driven

Customised Programs

Get Started

What is

Trade Credit Finance

from 121 Finance?

Our solutions are tailored to support SMEs and MSMEs tackle the trade credit gap. By extending credit for purchases and providing a flexible and reliable source of working capital, we empower both sides of the trade without disrupting the operations. We ensure businesses continue to operate smoothly while managing short-term needs.

Top Features of Trade Credit Finance

SME & MSME Oriented

Specifically designed to meet the needs of small and medium-sized enterprises

Customised Programs

Flexible solutions designed to fit your unique business needs

Instant Disbursements:

Get immediate access to funds ensuring uninterrupted business operations

RBI Registered NBFC-Factor

Ensuring transparency, compliance, and trust in every transaction

No Geographical Restrictions

Get the financing you need without any delay & seize new opportunities

Credit Option to New Buyers

Trade seamlessly across regions with no boundaries and grow your business

Value Added Benefits

Tackle Trade Credit Gap which is usually not available for

SMEs / MSMEs

Covers the

Credit Risk Management

Accounts Payable & Accounts Receivable Management

Benefits to Buyers

Instant Free Credit Period

Collateral Free Finance

2x Credit

Limits*

App Based

System

Growth Opportunities

Quick Approvals

Benefits to Sellers

Instant Disbursements

Seller Friendly

No Impact on Balance Sheet

Seller Portal

Risk-Free Solution

Customised Product

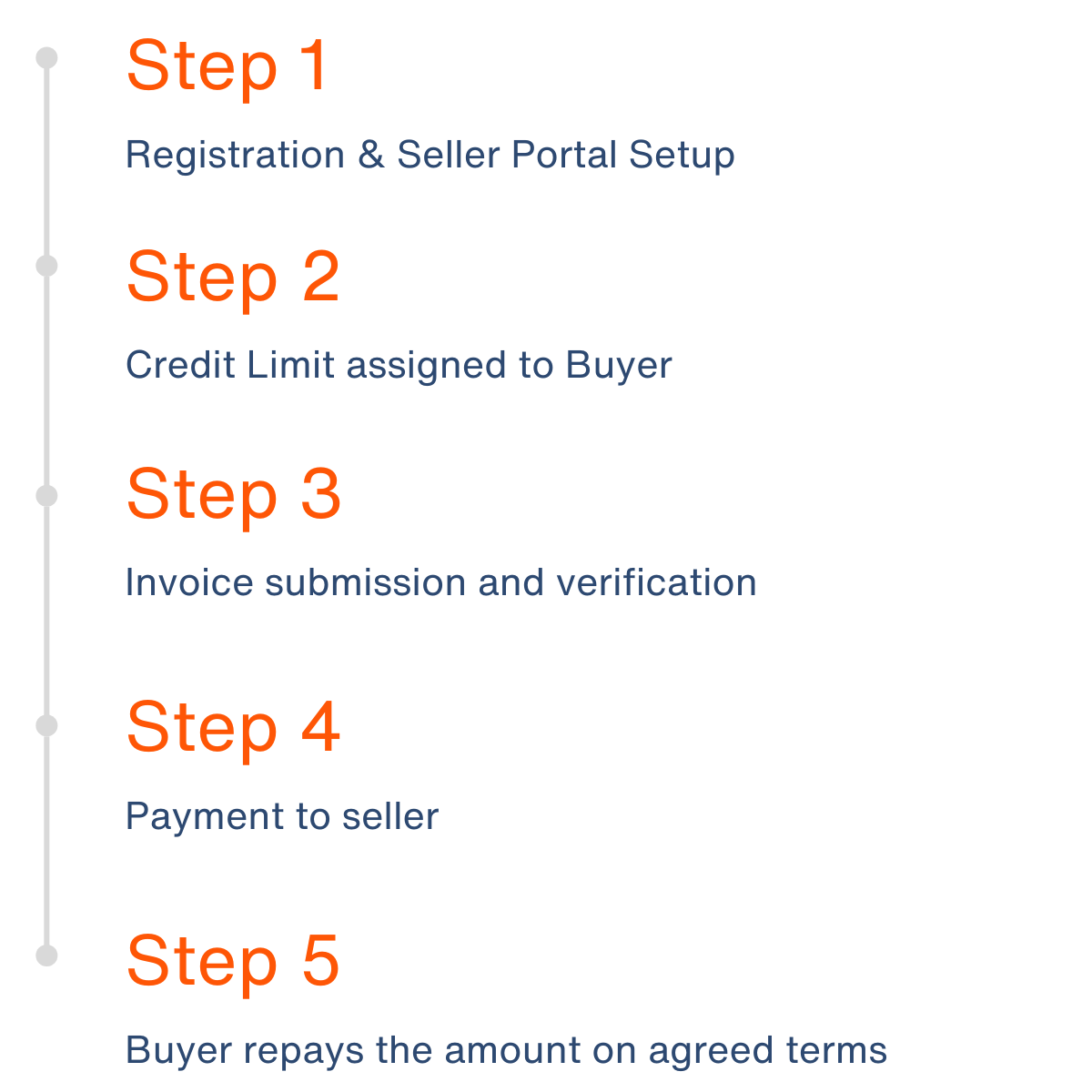

How it Works?

Step-by-Step Process to get Financed Quickly!

What we need?

GSTR details

for the past 12 months

Financial Statements

for the last 2 financial years

Bank Statements

for the immediate past one year

KYC Documents

for business & its owners

Additional Documentation

as required for approval*

FAQ

What is Trade Credit Finance and who can benefit from it?

Trade Credit Finance helps businesses with their purchases, allowing them to delay payments while maintaining smooth operations. Both buyers and sellers can benefit from extended payment terms and improved cash flow. It is like a channel finance from SME to MSME.

What is the difference between Trade Credit Finance and business loans?

Trade Credit Finance is transaction-specific and tied to a trade transaction, typically involving the purchase of goods or services. It provides flexibility for short-term financing needs, while business loans are generally broader financial products that have fixed repayment schedules and higher interest rates.

What is the eligibility criteria?

Eligibility depends on your business’s financial health, operational history, and trade volume. Typically, businesses with a minimum annual turnover of ₹5 crore and a business vintage of at least 3 years are eligible.

What is the maximum limit I can get for?

The limit depends on your specific financing needs, business eligibility, and our credit assessment. We offer competitive credit limits based on the trade volume and financial health of your business.