Factoring in Finance: Recourse & Non-Recouse Factoring

Table of Contents

Introduction

Financial management is the heart of every business along with the services/product they offer. It is the one area that can help business drive forward but with an effective financial strategy to tackle it. Making business finance the most important aspect at any given time or situation is crucial for reasons like growth, and sustainability.

One such scenario that usually disrupts the financial management of businesses is the traditional waiting period (about 2 months) which increases the administrative burden increases cash-flow gaps which results in the shortage of working capital. The role of cash flow stability is far too essential in the growth and success in the long term.

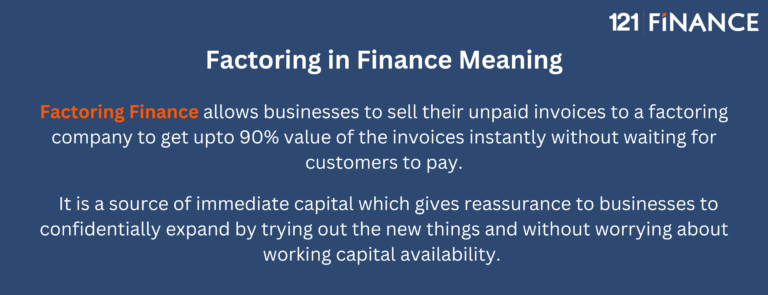

In today’s modern world, a versatile solution is smartly solving the working capital problems for businesses using the latest advancements in the digital world. Factoring finance provides a quick infusion of cash, enabling businesses to meet their working capital requirements without taking on additional debt or waiting for customer payments.

Factoring finance, which is also known as Invoice discounting or bill discounting in India is among the finest solution to access working capital solution available from the RBI certified NBFC-Factor.

Small and medium-sized businesses, startups, and those with limited credit history often struggle to secure traditional bank loans or lines of credit. Factoring finance offers an alternative funding option that relies on the creditworthiness of the business’s customers rather than the business itself, making it accessible to businesses that may not qualify for traditional financing.

Types of Factoring Finance

Factoring finance encompasses various types tailored to meet different business needs. The most common types of Factoring Finance are:

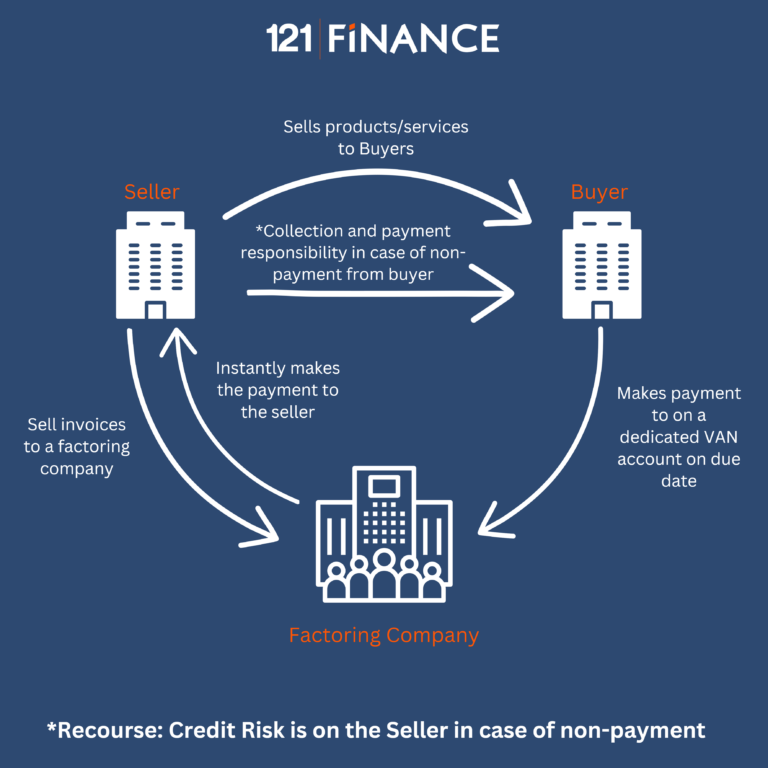

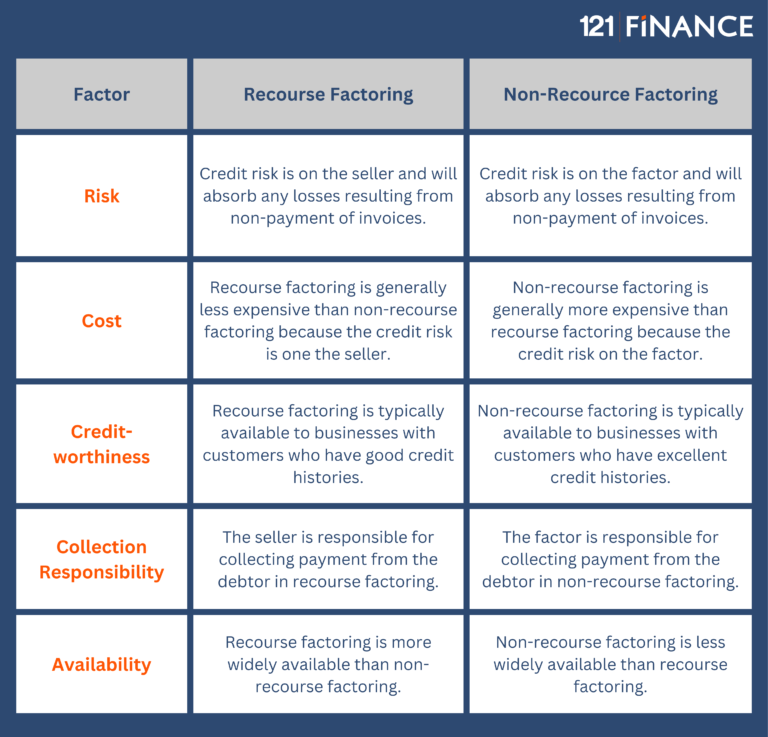

Recourse Factoring

Recourse Factoring is the most common type of invoice factoring in which the business selling its invoices to a factoring company gets the immediate cash for the services/products offer with one exception. The business holds the credit risk and not the Factor in the case of nonpayment from the customer. The whole debt collection process is also taken care of by the business itself.

Recourse factoring is risky for businesses because the client has no idea about the factoring agreement leaving the responsibility of payment on the business in case of non-payment.

Example

Let us assume a company “X” has unpaid invoices of 2 lack rupees from the customer which has used their services/products. To get the payment instantly, the “X” chooses recourse factoring to sell its invoices to a factoring company.

The “X” instantly gets 90% of the value of the invoice which is 1 lakh 80 thousand rupees minus the fee. In the case of recourse factoring, the credit risk of bad debts and collection services stays with the “X”. So, if the payment of 2 lakhs doesn’t come from the customer on the due date, the “X” must pay back to the factoring company.

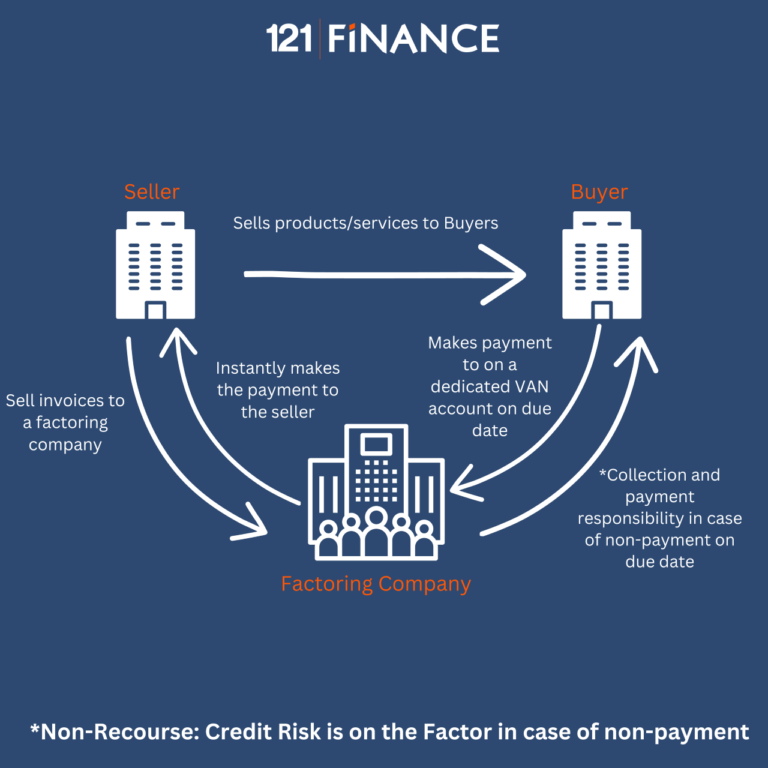

Non-Recourse Factoring

In non-recourse factoring also business sells its invoices to a factoring company and receives cash payments immediately but the credit risk is on the Factor. They take complete responsibility in case of non-payment from the customers irrespective of the size of invoice. The factoring company also takes all responsibility for analyzing the creditworthiness of the buyer, collection of payment on the due date and the credit loss arising on account of non-payment by the customer.

Non-recourse factoring is less risky for businesses because the client knows about the factoring and agrees to make the payment to the factor on the due date.

Example

Let us assume a company “X” has unpaid invoices of 2 lack rupees from the customer which has used their services/products. To get the payment instantly, the company chooses non-recourse factoring to sell its invoices to a factoring company.

Once again, the “X” will instantly get the 90% value of the invoice which is 1 lakh 80 thousand rupees minus the fee. But in the case of non-recourse factoring, the credit risk of bad debts and collection services is now the factoring company’s responsibility. They will take the action to collect the payment from the client and will also handle the losses of if the case of in case of non-payment.

Factoring in Finance with NBFC-Factor

Getting business finance has become quick and efficient in recent times. But the benefit of working with the RBI certified NBFC-Factor is something other NBFCs or modern apps can’t offer. You get the assurance that the business is collaborating with a company that is reputable, has a proven track record of success and has the best interest of your business.

It allows a business to keep focusing on running it efficiently because the finance partner will provide the best possible support when it comes to invoice financing.

We are 121 Finance, India’s first RBI certified NBFC-Factor post 2022 revised regulations. With a mission to bring Factoring Finance to the MSMEs, startups and to support small ticket size trade to grow, we offer customized finance solutions that aren’t traditionally available to small businesses. Connect with our expert today and learn more about our services.

Share this Article:

Unlock the true potential of your working capital

Read More

121 Digest – Why Businesses Still Struggle to Access Credit

January 2026 Issue: 25 Why Businesses Still Struggle to Access Credit? Quote of the Month "Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble" Did you Know?

Best Collateral-Free Financing Options for Small Businesses in India

Collateral Free Business Financing

Factoring vs Traditional Business Loans

Factoring Finance vs Traditional Loans Which is Better for Your Business? Factoring Finance isn’t a loan, it’s a smarter way to get paid faster and keep your business growth intact.

The Economic Power of Culture: How Global Cultural Habits Influence GDP Growth

The Economic Power of Culture How Global Cultural Habits Influence GDP Growth India being a country of festivals, starting the year with Pongal/Makar Sankranti and ending it with Christmas, it

Revenue Based Financing vs Factoring Finance

Revenue Based Financing vs Factoring Finance Which Flexible Funding Solution is Right for Your Business? Today, businesses are constantly looking for alternate funding options that can benefit them. They want

Introduction to Debtor Finance

Introduction to Debtor Finance