Factoring Finance - What it is and How it works

Table of Contents

Introduction

This article is for you if:

- have a B2B business – manufacturing / trading / service

- need Working Capital Finance

- want to increase your business’ productivity

- are part of an MSME

- want to know about Factoring Finance

Factoring Finance - what it is and how it works

Digitalization has made things simpler for businesses in almost every industry. Integration of digital technology has fundamentally changed how to operate and deliver value with ease. With the equivalent situation, the finance industry (users and lenders both) has hugely benefitted by the newly incorporated ease of receiving working capital and supply chain finance. It is almost like finding an oasis in the middle of the desert, especially given the challenges around procuring finance for MSMEs (Micro, Small and Medium Enterprises).

New-age NBFCs and FinTechs are together developing innovative solutions that smoothly fund businesses and are rapidly becoming an integral part of their growth and expansion. If you are an entrepreneur or running an MSME, the chances of coming across Factoring as a solution to finance your business needs are pretty high. Factoring Finance, which is now regulated by RBI (Reserve Bank of India), has allowed banks and exclusive NBFC-Factors (Factoring companies in India) to carry out Factoring in a regulated format under the recently amended Factoring Act.

Let this be your introductory guide to Factoring, and how easily it can help businesses eliminate struggles with payments to vendors, staff, faster operation cycles, growth and primarily help in maintaining important B2B relationships.

What is Factoring Finance?

Simply put, Factoring Finance in India is the best B2B Working Capital Finance solution, now regulated by RBI. Any seller can sell their Invoices to a Factoring company (NBFC-Factor or bank) and receive payments instantly, without waiting to honour the credit period. In Factoring, an invoice is treated as a business asset and not collateral, so there is no debt impact on the business. Factoring is available not just for manufacturers, but also for the service industry.

Factoring’s commonly known versions like ‘Accounts Receivables Finance’, ‘Invoice Discounting’ and ‘Commercial Finance’ have been practiced traditionally over years. The path breaking change in regulations by RBI have given ‘Factoring’ the legitimacy, and that coupled with tech driven efficient NBFCs, has created a radical change allowing businesses to receive payments for invoices instantly, which would typically take 30-90 days to convert, without any collateral. All of this for a small fee, keeping your relationship intact with the buyer of your product or service.

Highlights of Factoring Finance

Regulated by RBI

Collateral-free Finance

Sale of invoice (Business asset)

Get your invoice paid out immediately

Transparent and quick methods with best technology

No hassle of payment collection = better B2B relationships

No more traditional waiting period of 30-90 days for payments

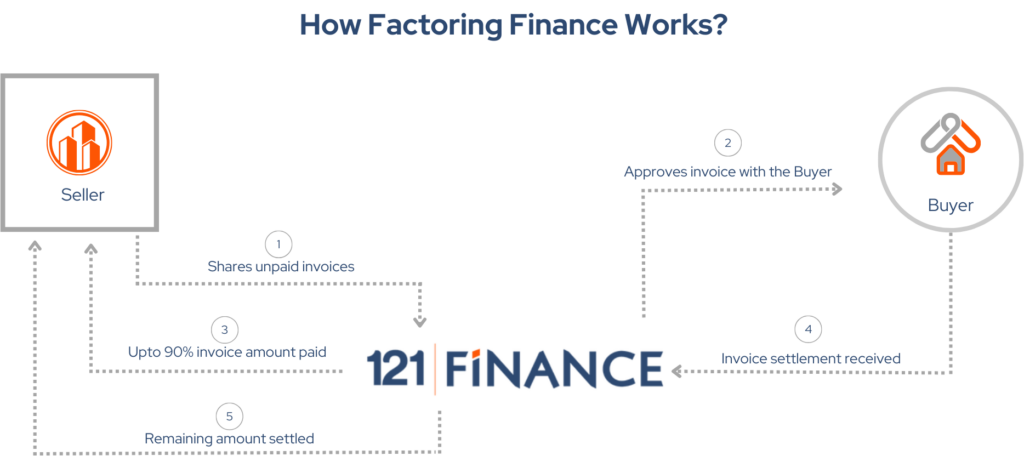

How does Factoring work?

- A business (seller) generates an invoice for the service/product they have delivered to their B2B client

- This invoice is shared with an NBFC-Factor for immediate payment

- The NBFC-Factor gets confirmation from the buyer and conducts a due diligence

- The underwriting of the buyer is done using a highly efficient RISK analysis algorithm

- Once the invoice is approved by the buyer, and the buyer is cleared for RISK analysis, the Factor makes a payment

- This payment is typically made instantly, up to 80% of the invoice value

- The seller can continue their business cycle and not worry about chasing any payments

- Upon completion of the credit period, the buyer makes a complete payment to the NBFC-Factor

- The Factor now keeps their service fee and makes the remaining payment to the seller.

Benefits of Using Factoring Finance

1. Eliminates the waiting period

Turning to alternative lenders to access business credit can be really helpful for small businesses. For instance, Factoring eliminates the 30, 60 or 90 days period to receive the money from the buyers. Perfect for businesses seeking instant cash to pay bills, employees and suppliers.

2. Swift and quick to get money in Your account

Traditional business loans follow a long-term strategy. It may work perfectly for established enterprises but it can be a menace for MSMEs looking for collateral-free short-term credit. With digital Factoring, the complete process from verification (approval) to disbursements, everything can happen within the period of 24 hours once the invoice is submitted.

3. Get finance without losing equity

Losing equity to access funds has become a trend. Losing share profit, loss of control and potential conflict can be hard for early-stage businesses. Factoring allows businesses to get access to cash flow without losing any portion of the company.

4. Improves business credit

Factoring enhances the cash flow in an organization. This makes it perfect to improve the business credit by meeting the commitments on time. The bigger the amount of invoice, the more the percentage a business gets in boosting the credit rating and having sufficient cash flow. Under this arrangement, the cash quickly builds up, allowing MSMEs to address operating costs and even expand business

5. Factoring allows to focus on business

Scarcity of cash is the biggest problem for businesses as it restricts progressive thinking. With growth as its main element, Factoring allows businesses to run their internal and external communications effectively and they can focus on other day-to-day needs by eliminating the cash-flow problems.

6. Do not have to factor all of receivables

Factoring does not have to be an all-or-nothing proposition. It depends on the business whether they choose to find some invoices and not others. This measured approach can help an organization become more familiar with the Factoring and learn whether this approach is a good fit for the company or not.

Conclusion

If your business is burdened with unpaid invoices, then Factoring is a great way to turn them into instant cash. Small business owners need to look for alternative financing solutions. And with the growth of Factoring Services in India, they can quickly boost the cash needs keep the business ahead of the game and scale on an upward trajectory.